Blue States Sue Trump Over Rule Limiting Student Loan Forgiveness for Teachers and Public Workers

A coalition of 21 Democratic-led states, Washington D.C., and several major cities has sued the Trump administration, arguing that a new rule from the U.S. Department of Education unfairly restricts eligibility for the Public Service Loan Forgiveness (PSLF) program.

The states claim the rule effectively punishes teachers, nurses, and public workers whose employers engage in activities that the administration deems “unlawful.”

The Rule at the Center of the Dispute

The Education Department’s new rule redefines what counts as a “qualifying employer” for PSLF. Under the change, organizations that “aid illegal immigration” or “support gender transition procedures for minors” could lose eligibility.

The department says the policy prevents taxpayer dollars from supporting “unlawful” groups. It’s scheduled to take effect July 1, 2026.

What Public Service Loan Forgiveness Was Meant to Do

The PSLF program, created in 2007 under President George W. Bush, cancels federal student loan debt after ten years of payments for borrowers working in government or nonprofit jobs. It was designed to attract professionals into public service roles by easing their long-term debt burden.

Blue States Say Rule Violates Federal Law

Led by New York Attorney General Letitia James, the lawsuit accuses the Trump administration of overstepping its authority under the Higher Education Act, which defines qualifying public service jobs as government or 501(c)(3) nonprofit work. “This administration has created a political loyalty test disguised as a regulation,” James said. “It’s unjust and unlawful to cut off forgiveness based on ideology.”

Cities, Unions, and Nonprofits Join the Fight

Major U.S. cities including Boston, Chicago, Albuquerque, and San Francisco joined the legal challenge, along with the American Federation of Teachers and the American Federation of State, County, and Municipal Employees. The plaintiffs warn that if the rule takes effect, thousands of public workers could lose access to forgiveness — worsening staffing shortages in schools, hospitals, and local governments.

Boston Mayor: “This Rule Hurts Our Teachers and First Responders”

Boston Mayor Michelle Wu said her city joined the lawsuit to protect local workers. “The Trump Administration’s actions threaten to make higher education even more expensive for Boston’s teachers, first responders, and civil servants,” Wu said, calling the rule “an attack on the people who keep our cities running.”

The Trump Administration’s Defense: ‘Commonsense Reform’

Under Secretary of Education Nicholas Kent defended the policy, calling it a “commonsense reform” to stop taxpayer dollars from supporting “organizations engaged in terrorism, child trafficking, or illegal immigration.” Kent dismissed the lawsuits as “politically motivated,” insisting the rule would be enforced “neutrally, without regard to ideology.”

Who Could Lose Forgiveness Under the Rule

Critics say the rule’s vague definition of “unlawful activities” could sweep up teachers, healthcare providers, and legal aid workers; particularly in blue states.

A public school employing inclusive curricula or a clinic offering gender-affirming care could suddenly find itself disqualified, leaving workers who’ve paid for years without relief.

How “Illegal Activity” Is Being Defined

The Education Department’s list of disqualifying activities included in the rule are

Aiding and abetting federal immigration violations

Supporting terrorism or violent protest

Facilitating gender-transition care for minors

Engaging in patterns of illegal discrimination

Borrowers working for affected employers could lose PSLF access for a decade unless the organization agrees to a corrective action plan.

Nonprofits Warn of Political Retaliation

The National Council of Nonprofits said the rule threatens the independence of charitable organizations.

“Nonprofits operate food banks, serve veterans, assist domestic violence survivors, deliver meals to seniors, respond to disasters, and much more. Nonprofits must be able to identify and meet those needs without political interference, fear of retribution, or exclusion from a program designed to support their employees.” the group said, warning of a “chilling effect” on public service hiring nationwide.

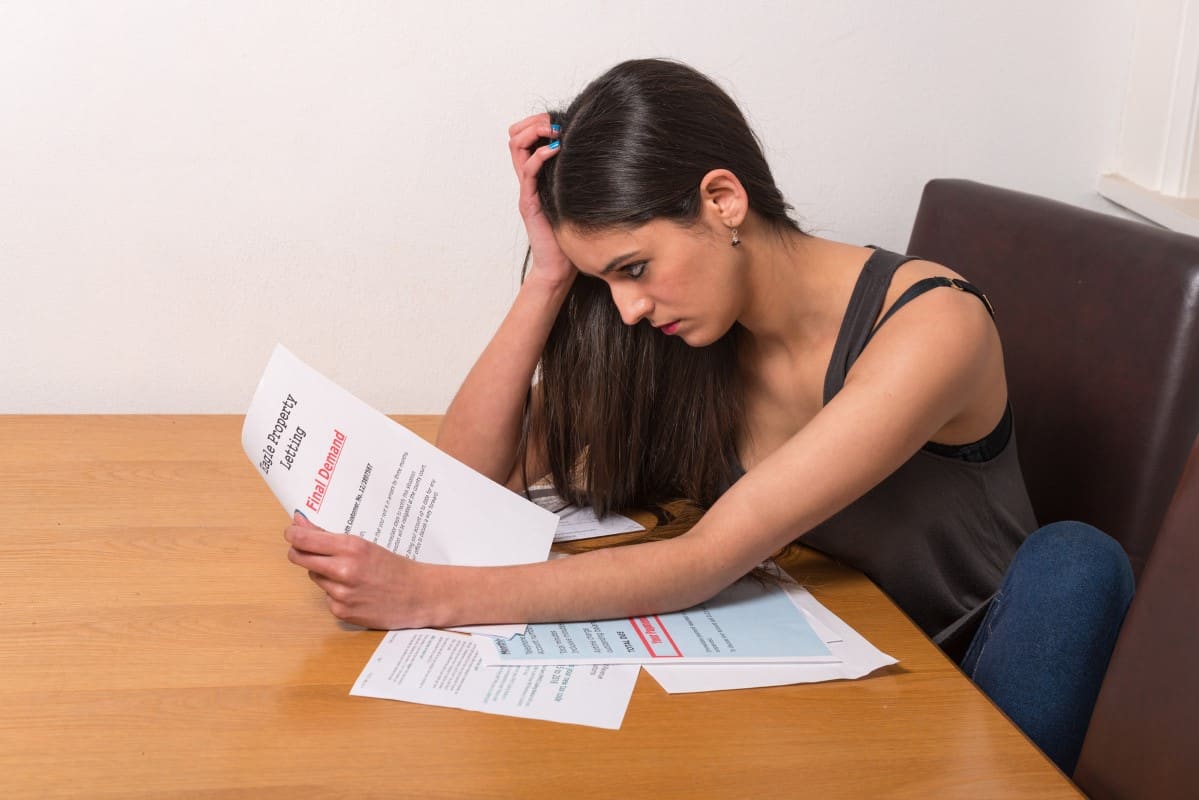

Borrowers Fear Years of Payments Could Be Wasted

Many public servants enrolled in PSLF worry they could lose forgiveness eligibility after years of payments if their employers fall out of compliance. Advocacy group Protect Borrowers said the rule “betrays the nonpartisan promise” of PSLF and “silences dissent” by linking financial relief to political alignment.

The March Executive Order That Started It All

The new rule stems from a March executive order signed by President Trump directing the Education Department to redefine “public service.” The order accused the Biden administration of “abusing PSLF” to channel tax dollars into “activist organizations that harm national security.”

Biden-Era Expansion Now at Risk

Under President Biden, the PSLF program was significantly expanded, leading to over 1 million borrowers receiving loan forgiveness. The Trump rule could roll back that expansion, limiting who qualifies and giving the Education Secretary broad discretion to revoke eligibility.

Legal Experts Warn of a Precedent

Legal analysts say the case could set a precedent for how much authority future administrations have to reshape forgiveness programs through executive action. A ruling in favor of the Trump administration could allow future presidents to redefine public service at will.

Democratic Leaders Denounce the Rule

Democratic lawmakers, including Sen. Bernie Sanders, have called for the rule’s immediate withdrawal. “You do not have the right to take away student debt forgiveness from teachers, nurses, and veterans for not showing loyalty to your agenda,” Sanders said on X. “This is a democracy, not a dictatorship.”

Millions of Borrowers Left in Limbo

As the lawsuits proceed, millions of borrowers in public service roles remain uncertain about their financial futures. If the courts uphold the rule, those working in blue-state cities or politically active nonprofits could find themselves paying for years longer than expected; or losing forgiveness altogether.

Like Financial Freedom Countdown content? Be sure to follow us!

Why Many Seniors Are Ditching Medicare Advantage for Medigap; Even With Higher Premiums

As Medicare open enrollment heats up, millions of seniors are facing one of the most consequential financial decisions of retirement: whether to stay with a Medicare Advantage plan or switch to a Medicare supplemental policy; better known as Medigap. The choice doesn’t just determine monthly costs; it can also affect access to doctors, treatment options, and out-of-pocket spending for years to come.

Why Many Seniors Are Ditching Medicare Advantage for Medigap; Even With Higher Premiums

Social Security’s 2.8% COLA Raise Could Be Wiped Out by Soaring Medicare Costs, Experts Warn

The Social Security Administration announced that monthly benefits will increase by 2.8% in 2026, slightly above this year’s 2.5% cost-of-living adjustment (COLA). While the news might sound positive, many seniors say it’s far from enough to keep pace with the surging cost of everyday necessities.

Social Security’s 2.8% COLA Raise Could Be Wiped Out by Soaring Medicare Costs, Experts Warn

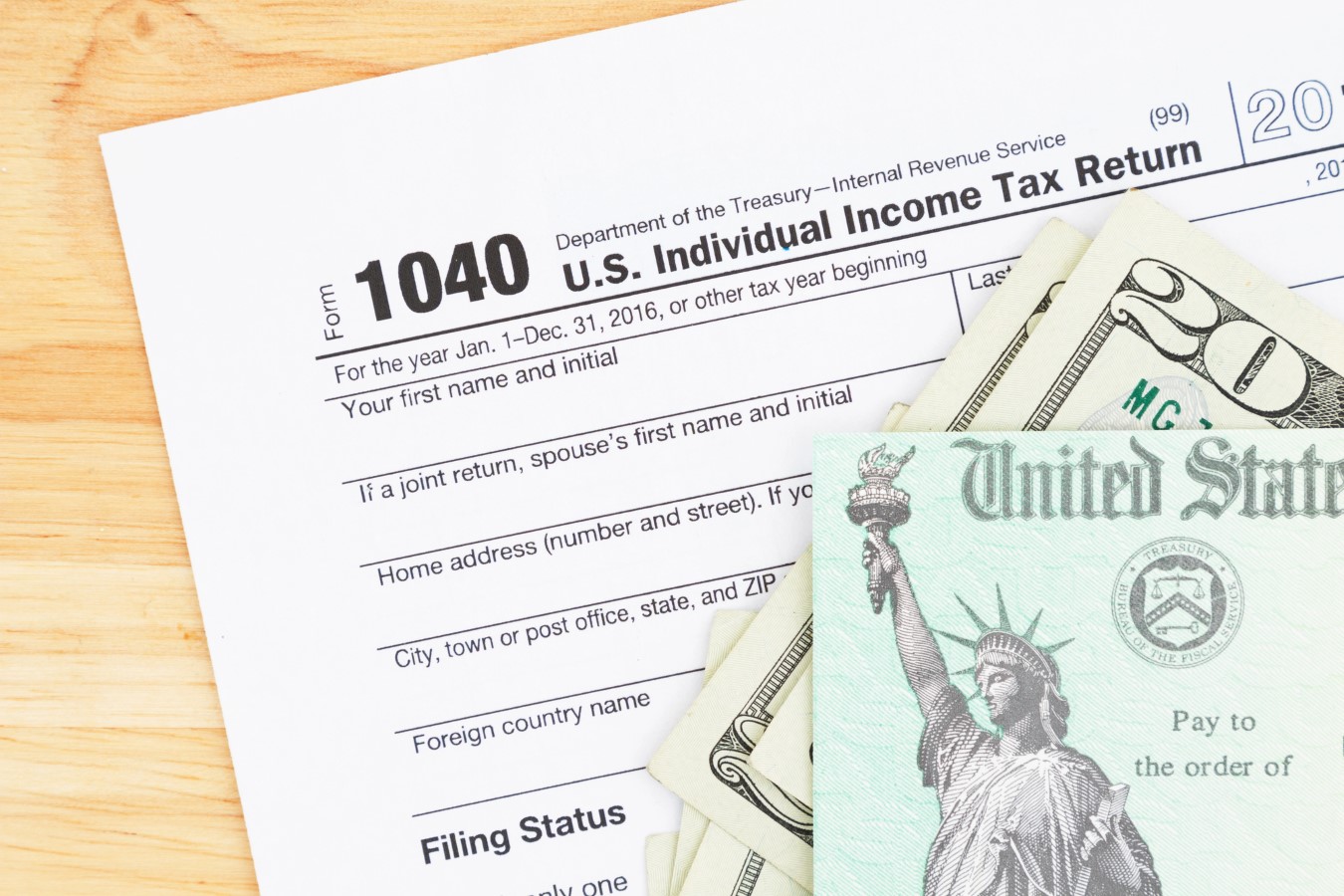

Big 2026 Refunds Ahead as Trump’s Tax Bill Kicks In, JPMorgan and Oxford Economics Say

Millions of Americans could see significantly larger tax refunds when they file their 2025 returns early next year; and both Oxford Economics and JPMorgan Asset Management say the surge is real. The driver behind the coming “refund wave” is former President Donald Trump’s “One Big Beautiful Bill Act,” a sweeping tax overhaul that took effect retroactively at the start of 2025. Both research firms say the combination of new deductions, delayed IRS withholding adjustments, and expanded tax breaks will result in tens of billions in overpaid taxes being refunded in 2026. Oxford Economics estimates that total taxpayer savings could reach $50 billion through bigger refunds or lower 2026 tax bills. JPMorgan’s strategists say the early-year refund bump could be strong enough to noticeably lift household spending and short-term economic growth.

Big 2026 Refunds Ahead as Trump’s Tax Bill Kicks In, JPMorgan and Oxford Economics Say

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Give the article a Thumbs Up on the top-left side of the screen.

3. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.