Small Caps, Rate Cuts, and Stock Selection

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

[With interest rate cuts now a reality and expected to continue to trend lower, it may be time to explore traditional thinking on the topic of small cap stocks, effects of rate cuts, and their investment implications. Upon further study, there may be a larger reality to focus on.

We decided to reach out to Eric Kuby, Chief Investment Officer, Peter Gottlieb, President, and Brooke Kuby, Research Analyst of North Star Investment Management – a Chicago-based investment firm with an expertise on applying a value lens to the small and micro-cap markets and developing non-traditional small-cap investment strategies – to hear their perspectives on the prevailing investor perceptions on small cap stocks, the nuances of the current market cycle, and the reinforcement of the need for a strategic versus tactical approach in active management of small cap markets.]

Hortz: What is the investment case for small cap stocks in a lowering interest rate environment? Are all rate-cutting cycles the same or are there other factors you need to account for?

Gottlieb: Small-cap companies tend to rely on shorter-term financing rather than issuing long-term bonds. As a result, the lowering of short-term rates improves their cost of capital and boosts their net income. The higher profits provide a nice tailwind for their stock prices.

Another aspect to consider, with 25% of small-cap value companies in the financial sector, is that a steepening yield curve improves the net interest margin for the banks, in that they typically borrow short while making longer-term loans.

Additionally, lower short-term rates boost consumer and industrial activity, benefiting companies in those sectors, which are also significant percentages of the small-cap value index.

Kuby: As to your question whether all rate-cutting environments are the same, we know that some strategists have been pointing out that rate-cutting cycles do not always lead to small-cap outperformance, but we think the factors that have led to this particular cycle should provide a nice lift to the category.

Examples of small-cap underperformance have more often come when the rate cuts have come during a crisis period, when smaller companies have been under challenging business conditions. This time, the economy is strong, and the rate cuts are coming to return policy to neutral from a restrictive level that was in place to combat inflationary pressures.

Hortz: Can you further share your perspectives on small-cap stocks in our current rate-cutting cycle?

Gottlieb: What is interesting about the current rate-cutting cycle is that there is both a strategic and tactical rationale making the case for small caps. On a strategic basis, small caps are trading at “trough valuations” on a relative basis on most metrics, such as the forward Price/Earnings multiple, compared to the rest of the market, which the following chart from Jeffries USA Equity Strategy Handbook outlines:

As value investors, we find that gap by itself to be a compelling reason for investors to allocate to the asset class where many currently have little or no holdings. Additionally, in a recent Barron’s article, LSEG forecasts Russell constituents to grow earnings by more than 50% on average over the next four quarters (five times the pace of S&P 500 earnings), while Jefferies projects 19.1% growth in 2026 versus 12.2% for large caps. So, you have inexpensive stocks with superior growth prospects.

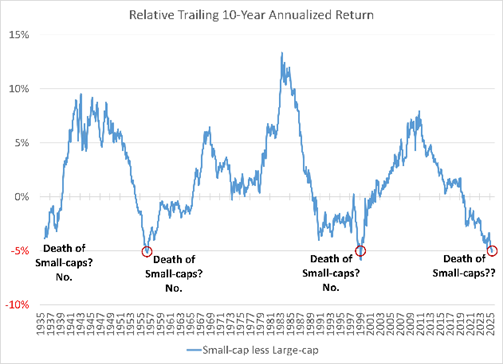

Kuby: On a tactical basis, this chart below from Furey Research Partners demonstrates there has been a pattern over the last few decades of extended periods of underperformance, bottoming out when the consensus amongst investors is that small caps are dead.

That has proven to be the moment when the tide turns, leading to a lengthy period of substantial outperformance. We think we reached that moment earlier this year. The rate-cutting cycle provides a rationale for tactical investors to seize the moment. The tariff-related inflation concerns that have dominated the narrative, leading to restrictive monetary policy and putting a lid on small caps, have not materialized. The Fed has relented and shifted to a policy that promotes growth and should take that lid off the small caps.

Hortz: As investment managers, how do you address these different macro and market issues, concerns, and opportunities in the small-cap markets?

Gottlieb: There are always macro issues that raise concerns, yet the stock market has consistently climbed the wall of worry to reach new heights. The most important ingredient in being a successful investor, particularly in small caps, is your selection process. It is best to think strategically bottom-up than just tactically (timing), since stock selection refines even tactical players’ positioning in the best companies for the given environment.

Kuby: There are thousands of small-cap companies, many of which have poor business models and balance sheets or are facing significant headwinds. At North Star, Peter Gottlieb and I as co-managers have worked together for decades, constantly refining our research process to identify the companies that offer the best risk-adjusted returns. Over time, the breadth of the small-cap universe has led us to develop three differentiated strategies: a micro-cap strategy focused on under-researched value opportunities, a small-cap dividend strategy designed for income-oriented investors, and a small-cap value strategy targeting larger, growth-oriented names.

Brooke Kuby: Our portfolio companies’ management teams also run their firms to address many of the current concerns in discussion. There are always going to be winners and losers, which is why active management can outmaneuver indexing in small-caps right now and across all environments. Stock selection is paramount!

Hortz: Can you explain your stock selection process and how it is designed to uncover resilient companies?

Brooke Kuby: Our process begins with a disciplined screen for valuation, balance sheet strength, and cash flow generation. We identify companies trading at discounts on several metrics, such as EV/EBITDA, P/E, or free cash flow yield. My weekly screening and idea exchanging with fellow small-cap enthusiasts is designed to surface durable businesses trading at undervalued levels, with clear pathways to long-term upside.

From there, we evaluate every company through a Six Pillar process. We further examine the stock’s valuation, durability across business cycles, capital structure stability, a defined path to earnings growth, shareholder-aligned leadership, and a transparent, understandable business model.

We then stress-test these pillars through management calls. Engaging with management is a crucial part of our process. Preparation means digging into capital structure, segment reporting, and historical financial trends. I aim to move beyond guidance and test how candid and disciplined leaders are in navigating challenges. The questions I ask are designed to uncover the real drivers of decision making (“What makes free cash flow diverge from net income?” or “What keeps your customers from delaying purchases in a tougher environment?”). I am also aware of tone and transparency; avoidance, excessive optimism, or generic responses are red flags. Thoughtful, data-backed answers signal credibility.

This combined process addresses systemic risks that can derail value. It helps us detect whether reported numbers reflect true economic reality, surface risks like debt that may not show up in headline financials, and test how management plans to navigate inflation, labor tightness, or regulation. Just as importantly, it creates a documented trail of assumptions and management responses, which keeps our research dispassionate and accountable over time.

Hortz: Can you discuss a number of your portfolio companies that illustrate these points?

Brooke Kuby: There are several North Star holdings that are insulated from macroeconomic fluctuations.

Employers continue to face shortages of mechanics, welders, electricians, and nurses regardless of broader GDP trends. Lincoln Educational Services (LINC) is a career-focused education provider specializing in skilled trades and healthcare training across a network of U.S. campuses. Tuition is raised 2-3% annually, effectively offsetting inflation without meaningful enrollment loss.

Footwear is discretionary, but Rocky Brands (RCKY) has insulated itself from trade risk. Manufacturing in the Dominican Republic reduces reliance on Asia and helps sidestep potential tariff shock. Many peers manufacture in Mexico – if trade tensions rise, RCKY’s footprint (no pun intended) becomes a relative tailwind. There are several demand levers in place, with the XTRATUF brand growing faster than they can supply, and Lehigh, tied to workplace safety spending, growing faster than GDP.

Liquidity Services (LQDT), an online marketplace operator that helps governments and corporations manage, sell, and repurpose surplus and returned assets, is positioned as a “constant cyclical” business. When economies expand, retailers and governments liquidate excess inventory; in downturns, bankruptcies and cost-cutting fuel more surplus supply. Buyers on LQDT platforms are value-seekers, benefiting from inflationary environments. The model is an asset-light, digital marketplace with no direct tariff exposure.

Bank of Hawaii (BOH) is one of our highest-quality bank holdings. Regional banks depend on local economic health. Hawaii’s economy (tourism, real estate, and military spending) enables steady earnings growth and a well-supported dividend. Inflation is less of a cost-driver for banks compared to other companies, and regional banks tend to benefit from lighter regulation with lower compliance costs and greater flexibility in lending.

Hortz: Any other thoughts you would like to share about small cap investing?

Kuby: Investors should keep in mind that our bottom-up stock selection process has been uncovering higher and higher quality companies regardless of tactical reasons or specific market environments as we continue to track hundreds of names and maintain a constant pipeline of ideas.

Gottlieb: Even so, small caps today offer a rare setup: inexpensive valuations at multi-decade discounts to large caps paired with superior earnings growth prospects both in the near term and into 2026. At the precipice of another rate-cutting cycle, we believe this creates a compelling case for a reasonable allocation to a diversified basket of high-quality small-caps.

This article was originally published here and is republished on Wealthtender with permission.

About the Author

Bill Hortz

Founder Institute for Innovation Development

Bill Hortz is an independent business consultant and Founder/Dean of the Institute for Innovation Development- a financial services business innovation platform and network. With over 30 years of experience in the financial services industry including expertise in sales/marketing/branding of asset management firms, as well as, creatively restructuring and developing internal/external sales and strategic account departments for 5 major financial firms, including OppenheimerFunds, Neuberger&Berman and Templeton Funds Distributors. His wide ranging experiences have led Bill to a strong belief, passion and advocation for strategic thinking, innovation creation and strategic account management as the nexus of business skills needed to address a business environment challenged by an accelerating rate of change.